Getting The Hsmb Advisory Llc To Work

Table of ContentsThings about Hsmb Advisory LlcSome Known Details About Hsmb Advisory Llc Everything about Hsmb Advisory LlcRumored Buzz on Hsmb Advisory LlcNot known Incorrect Statements About Hsmb Advisory Llc Excitement About Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Also realize that some policies can be costly, and having particular health and wellness conditions when you apply can increase the costs you're asked to pay. Health Insurance St Petersburg, FL. You will certainly need to ensure that you can pay for the costs as you will certainly need to commit to making these settlements if you want your life cover to continue to be in placeIf you feel life insurance can be advantageous for you, our partnership with LifeSearch enables you to get a quote from a number of service providers in double quick time. There are various kinds of life insurance that aim to meet various protection requirements, consisting of level term, reducing term and joint life cover.

Little Known Facts About Hsmb Advisory Llc.

Life insurance gives 5 monetary advantages for you and your family (Insurance Advisors). The major benefit of adding life insurance coverage to your financial plan is that if you die, your beneficiaries get a round figure, tax-free payment from the plan. They can utilize this money to pay your last costs and to change your revenue

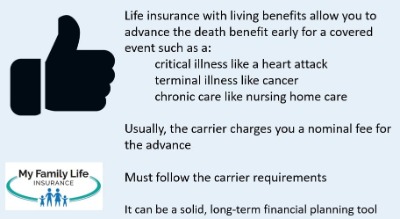

Some policies pay out if you establish a chronic/terminal illness and some give savings you can make use of to support your retired life. In this write-up, discover the numerous benefits of life insurance policy and why it may be an excellent idea to invest in it. Life insurance policy provides advantages while you're still alive and when you pass away.

The Main Principles Of Hsmb Advisory Llc

If you have a policy (or plans) of that size, individuals that depend upon your revenue will certainly still have money to cover their recurring living expenses. Recipients can make use of plan advantages to cover essential everyday expenses like rent or mortgage repayments, utility expenses, and groceries. Typical annual expenditures for households in 2022 were $72,967, according to the Bureau of Labor Stats.

Our Hsmb Advisory Llc PDFs

Furthermore, the cash money worth of whole life insurance grows tax-deferred. As the money value develops up over time, you can utilize it to cover expenditures, such as acquiring a vehicle or making a down repayment on a home.

If you make a decision to borrow versus your money worth, the financing is not subject to earnings tax as long as the policy is not surrendered. The insurance provider, nonetheless, will certainly bill rate of interest on the lending quantity up until you pay it back (http://www.place123.net/place/hsmb-advisory-llc-saint-petersburg-unite-states). Insurer have varying rate of interest on these finances

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

8 out of 10 Millennials overstated the expense of life insurance policy in a 2022 study. In reality, the average cost is better to $200 a year. If you think buying life insurance policy might be a wise economic step for you and your family, take into consideration seeking advice from a financial advisor to embrace it into your monetary plan.

The five main kinds of life insurance are term life, whole life, global life, variable life, and final expenditure insurance coverage, also recognized as interment insurance policy. Entire life begins out costing a lot more, but can last your whole life if you keep paying the premiums.

The Definitive Guide for Hsmb Advisory Llc

It can repay your financial debts and medical expenses. Life insurance might likewise cover your home loan and give money for your family members to maintain paying their bills. If you have household depending upon your income, you likely require life insurance policy to sustain them after you pass away. Stay-at-home parents and company owner also commonly need life insurance coverage.

Essentially, there are two kinds of life insurance policy plans - either term or long-term strategies or some mix of the 2. Life insurers provide various forms of term strategies and traditional life policies along with "rate of interest delicate" items which have actually become much more common given that the 1980's.

Term insurance policy gives protection for a specified amount of time. This period can be as short as one year or offer protection for a particular variety of years such as 5, 10, 20 years or to a specified age such as 80 or sometimes as much as the earliest age in the life insurance mortality.

The Definitive Guide for Hsmb Advisory Llc

Currently term insurance prices are really competitive and amongst the most affordable traditionally experienced. It must be noted that it is an extensively held belief that term insurance policy is the least expensive pure life insurance policy protection offered. One requires to review the plan terms carefully to make a decision which term life alternatives appropriate to fulfill your particular situations.

With each brand-new term the premium is raised. The right to restore the policy without evidence of insurability is a crucial advantage to you. Otherwise, the risk you take is that your wellness might weaken and you might Get More Info be not able to acquire a plan at the very same rates or perhaps in all, leaving you and your beneficiaries without protection.